Can i deduct dental implants on my taxes

Can I write off a new cell phone purchase?

Landline and Mobile (Unless Business Related) And if you have a second landline specifically for business use, you can deduct the full cost. Cell phones are a legitimate deductible expense if you are self-employed and use your phone for business purposes. On the same subject : How to help dental implant recovery reddit. It is recommended that you obtain a detailed bill to prove this.

Can the purchase of a new phone be tax-deductible? If you purchased a smartphone, tablet, or other electronic device, you can also claim a percentage of the cost deduction based on work-related use. If an item costs less than $ 300, you can apply for an immediate deduction.

Can you write off a new cell phone for work?

Deductions for Employees If you itemize deductions, the IRS allows you to claim your phone’s amortization as an “unrefunded business expense” if you use it regularly in your job and it is a common and accepted business practice. This may interest you : How much are dental implants in lakeland florida.

Can you write off the purchase of a cell phone?

When you buy a smartphone, you can deduct this cost. Again, you need to determine how much of its use will be for business use and how much for personal use. This may interest you : Tooth Extraction For Dentures Recovery Time. Since a smartphone can be considered a business asset, it can be depreciated, explains TurboTax, and claiming a partial deduction over several years.

How do I write off my cell phone on my taxes?

If you are self-employed and use your mobile phone for business purposes, you can claim a tax deduction for business use. If you spend 30 percent of your phone time on business, you can legally deduct 30 percent of your phone bill.

Can I claim medical devices on my taxes?

You can deduct the cost of medical equipment, as long as you have documentation confirming its acceptance or recommendation by a specialist doctor. You do not need a prescription, but it must help with the person’s medical care or health.

What medical costs are deductible in 2021? You can only deduct an amount for total medical expenses that exceeds 7.5% of your adjusted gross income. You calculate the amount that can be deducted in Schedule A (form 1040).

What medical expenses are tax deductible 2020?

The IRS allows you to deduct unrepaid charges for preventive care, treatment, surgery, dental and ophthalmic care, visits to psychologists and psychiatrists, prescription drugs, devices such as glasses, contact lenses, artificial teeth and hearing aids, and travel expenses for qualified medical care.

What qualifies as medical expenses for taxes?

You can deduct non-refundable eligible medical and dental expenses that exceed 7.5% of your AGI. 1 Suppose you have an AGI of $ 50,000 and your family has $ 10,000 in medical bills in a tax year. You can deduct any expenses above $ 3,750 ($ 50,000 × 7.5%) or $ 6,250 in this example ($ 10,000 – $ 3,750).

What medical deductions can you claim on taxes?

For tax returns filed in 2022, taxpayers can deduct eligible non-reimbursed medical expenses that is more than 7.5% of their adjusted gross income in 2021. So if your adjusted gross income is $ 40,000, anything that exceeds the first $ 3,000 medical bills – or 7.5% of the AGI – may be deductible.

What medical devices are tax deductible?

Eligible Medical Expenses For Tax Deductions

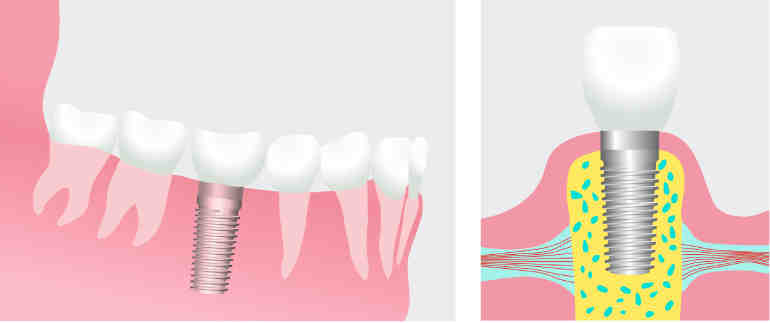

- Artificial limbs and teeth.

- Braille books and magazines.

- Ball rental or purchase.

- A device that displays the audio part of television programs as subtitles for people with hearing impairments.

- Glasses, contact lenses and related equipment.

What medical expenses are deductible 2021?

You can deduct non-refundable eligible medical and dental expenses that exceed 7.5% of your AGI. 1 Suppose you have an AGI of $ 50,000 and your family has $ 10,000 in medical bills in a tax year. You can deduct any expenses above $ 3,750 ($ 50,000 × 7.5%) or $ 6,250 in this example ($ 10,000 – $ 3,750).

Is a walker a deductible medical expense?

According to the IRS website, medical expenses may be deductible for you, your spouse or a dependent. The IRS defines DME as “certain medical equipment that is ordered by a physician for home use.” Walkers, wheelchairs and hospital beds were mentioned as examples.

Can you claim out of pocket medical expenses on your taxes?

If the medical bills you pay out-of-pocket during the year exceed 7.5 percent of your Adjusted Gross Income (AGI), you can only tax deductible medical expenses that exceed 7.5 percent of your AGI. You also need to itemize your deductions to deduct medical expenses.

Are over the counter drugs tax deductible in 2021?

Don’t forget to include the cost of insulin and prescription drugs – but remember that over-the-counter (OTC) drugs are not deductible.

What medical costs are tax deductible in 2021? In 2021, the IRS allows all taxpayers to deduct eligible non-reimbursed medical expenses that exceed 7.5% of their adjusted gross income. You must itemize your deductions in IRS Schedule A in order to deduct medical expenses.

Are vitamins tax deductible 2021?

Yes, you can deduct vitamins if they are specifically prescribed by your doctor to treat your medical condition. If you take them for general health, they are not deductible.

Are OTC drugs deductible in 2021?

Don’t forget to include the cost of insulin and prescription drugs – but remember that over-the-counter (OTC) drugs are not deductible.

Can I use my HSA for over-the-counter medication 2021?

If you have a Savings Account (HSA) or Flexible Spend (FSA) account, you can now use these funds for several popular drugs, medications, and over-the-counter (OTC) products.

Can I claim over-the-counter medications on my taxes?

However, you cannot count down over-the-counter medications (meaning those medications or medications that do not need to be prescribed). This includes aspirin, vitamins, antibiotic creams, and other over-the-counter medications, even if your doctor tells you to buy them.

Are over-the-counter medications tax deductible in 2020?

Effective January 1, 2020, CARES treats all OTC drugs and menstrual care products as qualifying medical expenses that can be paid (or reimbursed) tax-free by the HSA, Health FSA, HRA or Archer MSA.

Can you use cosmetic surgery as a tax deduction?

IRS rules for plastic surgery Any treatment costs you incur due to “unnecessary plastic surgery” are not deductible. The IRS allows you to write off treatment costs that are associated with procedures that treat a condition or disease, heal or restore the body, or improve overall health.

Can you deduct a tax on cosmetic surgery in Canada? Expenditure on a cosmetic procedure qualifies as eligible medical expenditure if it is necessary for medical or reconstructive purposes, such as surgery to remove a deformity associated with a congenital defect, accidental or trauma injury, or disfigurement.

Is gastric sleeve surgery tax deductible in Canada?

Usually yes. To verify this in a specific case, we recommend that you consult your accountant and / or use the website of the Tax Office.

Can you write off gastric sleeve on taxes?

Most people are unaware of this, but bariatric surgery, whether it’s a hip band, gastric sleeve, or gastric bypass, qualifies as a medical cost to be eligible for taxes. Weight loss surgery, supplements, and medications that you buy all year round can be of financial benefit to you.

Can you claim weight loss surgery on taxes Canada?

You may be eligible to submit the Lap-Band® procedures or gastric sleeve as a medical cost on your tax return. Talk to your financial or accounting advisor, or visit the Canada Revenue Agency for more information.

What medical devices are tax deductible?

Eligible Medical Expenses For Tax Deductions

- Artificial limbs and teeth.

- Braille books and magazines.

- Ball rental or purchase.

- A device that displays the audio part of television programs as subtitles for people with hearing impairments.

- Glasses, contact lenses and related equipment.

Which medical supplies are tax deductible? The IRS allows you to deduct unrepaid charges for preventive care, treatment, surgery, dental and ophthalmic care, visits to psychologists and psychiatrists, prescription drugs, devices such as glasses, contact lenses, artificial teeth and hearing aids, and travel expenses for qualified medical care.

What medical expenses are deductible 2021?

You can deduct non-refundable eligible medical and dental expenses that exceed 7.5% of your AGI. 1 Suppose you have an AGI of $ 50,000 and your family has $ 10,000 in medical bills in a tax year. You can deduct any expenses above $ 3,750 ($ 50,000 × 7.5%) or $ 6,250 in this example ($ 10,000 – $ 3,750).

Which of the following expenses is 100% deductible in 2021?

Pursuant to the new act for 2021 and 2022, business meals delivered by restaurants are 100% deductible, subject to the conditions specified in the existing IRS regulations.

What qualifies as a deductible medical expense?

Deductible medical expenses may include but are not limited to: Payment of the fees of doctors, dentists, surgeons, chiropractors, psychiatrists, psychologists and non-traditional doctors.

Is a walker a deductible medical expense?

According to the IRS website, medical expenses may be deductible for you, your spouse or a dependent. The IRS defines DME as “certain medical equipment that is ordered by a physician for home use.” Walkers, wheelchairs and hospital beds were mentioned as examples.

What qualifies as a deductible medical expense?

Deductible medical expenses may include but are not limited to: Payment of the fees of doctors, dentists, surgeons, chiropractors, psychiatrists, psychologists and non-traditional doctors.

What medical equipment is tax deductible?

Durable medical equipment is only deductible when ordered by a doctor and used to alleviate or prevent physical or mental illness. Items used for general health, not related to a medical condition, are not deductible as durable medical equipment. Deduct amounts paid in the current tax year.

Comments are closed.