Are dental implants deductible for income tax

If you itemize your deductions for the tax year on Schedule A (Form 1040), Itemized Deductions, you may be able to deduct the expenses you paid for medical and dental care for yourself, your spouse and dependents this year.

What are qualified medical expenses?

Qualified medical expenses are generally the same types of services and products that would otherwise be deductible as medical expenses on your annual income tax return. To see also : Will dental implants get cheaper. Some qualified medical expenses, such as doctor visits, lab tests, and hospital stays, are also Medicare-covered services.

Which medical expenses are tax deductible in 2022? 2022 Standard Deduction In addition, in 2022 you can only deduct unreimbursed medical expenses that exceed 7.5% of your adjusted gross income (AGI), which can be found on line 11 of your 2022 Form 1040. For example, if your AGI is $50,000, the first $3,750 of qualified expenses (7.5% of $50,000) are not taken into account.

What is not considered a qualified medical expense?

Expenses are NOT eligible under an HSA life insurance or income protection policy. The hospital insurance benefits tax that is withheld from you is paid as part of social security tax, or you pay social security as part of self-employment tax. Read also : What should dental implants cost in fort wayne indiana. Nursing care of a healthy child. Traveling doctor told you to rest or…

Which of the following is excluded in a medical expense plan?

X-rays, medications, and dental treatments are usually excluded. Comprehensive major medical plans cover all major medical expenses under one policy and are not coordinated with basic plans.

What are not qualified medical expenses?

They do not include expenses that are only good for general health, such as vitamins or vacations. Medical expenses include the premiums you pay for insurance that covers the cost of medical care and the amounts you pay for transportation to get medical care.

What are qualified medical expenses for tax purposes?

You can calculate the amount you’re allowed to deduct using Schedule A (Form 1040). Medical expenses include payments for the diagnosis, treatment, mitigation, treatment or prevention of diseases or payments for treatment affecting any structure or function of the body. See the article : Dental Implants Charleston Sc.

What does the IRS consider medical expenses?

Medical costs are the costs of diagnosing, treating, mitigating, curing or preventing diseases and affecting any part or function of the body. These costs include paying for legal medical services provided by doctors, surgeons, dentists and other medical professionals.

Are toothbrushes deductible?

As toothbrushes are considered general health products, they cannot be reimbursed.

Is the electric toothbrush tax deductible? Medical expenses that are not tax-deductible Health-related items such as toothpaste and toothbrushes, exercise memberships, vitamins and supplements, and diet plans are not deductible.

What dental expenses are tax deductible?

Medical expenses include dental expenses, and in this publication the term “medical expenses” is often used to refer to medical and dental expenses. You can only deduct the portion of your medical and dental expenses on Schedule A (Form 1040) that is more than 7.5% of your adjusted gross income (AGI).

Are dental crowns tax deductible?

Veneers, crowns and caps placed on teeth for cosmetic reasons cannot be deducted or counted against your medical expenses when declaring taxes. Internal Revenue does not allow a taxpayer to deduct work done on healthy teeth simply to make a person look more attractive.

What dental expenses are not tax deductible?

Cosmetic Dentistry Costs Indeed, people often go to dentists because they want their crooked teeth straightened or their stained teeth whitened. The IRS specifically says that expenses related to cosmetic surgery, including cosmetic dentistry, are not eligible for tax credits.

Is a toothbrush HSA eligible?

Toothbrushes cannot be reimbursed by Flexible Spending Accounts (FSA), Health Savings Accounts (HSA), Health Benefit Accounts (HRA), Nursing Care Flexible Spending Accounts and Limited Purpose Flexible Spending Accounts (LPFSA) as they are general healthcare products.

Are toothbrushes FSA HSA eligible?

Electric toothbrushes and spare parts General health items such as toothbrushes are not eligible for reimbursement from the FSA because they are used even without a dentist’s recommendation.

What products are HSA eligible?

These are the most common HSA expense items

- Pays for prescriptions and office visits.

- Crutches.

- Dental treatment (see below)

- Flu shots.

- Hearing aids.

- Prescription drugs.

- Vision care (see below)

- A wheelchair.

Can you write off medical and dental expenses on taxes?

Medical expenses include dental expenses, and in this publication the term “medical expenses” is often used to refer to medical and dental expenses. You can only deduct the portion of your medical and dental expenses on Schedule A (Form 1040) that is more than 7.5% of your adjusted gross income (AGI).

How much can you deduct for medical expenses in 2022? You can deduct unreimbursed qualified medical and dental expenses that exceed 7.5% of your AGI. 1 Let’s say your AGI is $50,000 and your family has $10,000 in medical bills during the tax year.

What dental expenses are not tax deductible?

Cosmetic Dentistry Costs Indeed, people often go to dentists because they want their crooked teeth straightened or their stained teeth whitened. The IRS specifically says that expenses related to cosmetic surgery, including cosmetic dentistry, are not eligible for tax credits.

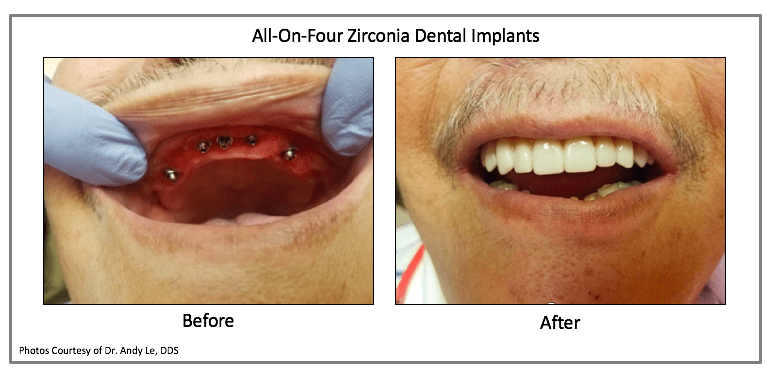

Are dental implants deductible on taxes?

Yes, dental implants are tax deductible. It also explains: “Medical expenses include payments for the diagnosis, treatment, mitigation, treatment or prevention of disease, or payments for treatment that affects any structure or function of the body.” This would include dental implants.

Are all dental expenses tax deductible?

The IRS allows you to deduct unreimbursed payments for preventive care, treatments, surgeries, dental and vision care, psychologist and psychiatrist visits, prescription drugs, devices such as glasses, contacts, false teeth and hearing aids, and travel expenses. for qualified medical care.

What healthcare expenses are tax deductible?

Medical treatments such as surgeries and preventive care are taxable. Prescription drugs and essential items like glasses and hearing aids are also tax deductible, and you can even deduct driving expenses like parking fees, bus tickets and gas mileage.

Can I claim my health insurance premiums on my taxes?

Health insurance premiums are federally tax deductible in some cases because these monthly payments are classified as medical expenses. Generally, if you pay for health insurance yourself, you can deduct the amount from your taxes.

What are the itemized deductions for 2022?

Itemized deductions

- Standard deduction and itemized deductions.

- Deductible non-business taxes.

- Personal property tax.

- Property tax.

- Sales tax.

- Charitable contributions.

- Gambling loss.

- Other expenses.

Should I itemize or take the standard deduction in 2022? Claiming the standard deduction is easier because you don’t have to track expenses. The standard deduction for 2022 is $12,950 for single filers ($19,400 if you’re head of household), $25,900 for married filers, and a little more if you’re over 65.

What dental procedures are tax deductible?

Only medically necessary dental treatments such as cleanings, sealants, fluoride treatments, x-rays, fillings, braces, extractions, dentures and dental-related prescription drugs are deductible. Cosmetic procedures (such as veneers and teeth whitening) and over-the-counter medications are not tax deductible.

What dental expenses are not deductible? Cosmetic Dentistry Costs Indeed, people often go to dentists because they want their crooked teeth straightened or their stained teeth whitened. The IRS specifically says that expenses related to cosmetic surgery, including cosmetic dentistry, are not eligible for tax credits.

Can I write off a root canal on my taxes?

Medicine isn’t just medical The IRS allows dental and vision tax credits in addition to medical expenses. This means you can deduct eye exams, contacts, glasses, dental visits, braces, dentures and root canals.

Can you write off dental crowns on taxes?

Veneers, crowns and caps placed on teeth for cosmetic reasons cannot be deducted or counted against your medical expenses when declaring taxes. Internal Revenue does not allow a taxpayer to deduct work done on healthy teeth simply to make a person look more attractive.

What is the most you can claim without receipts?

When can I claim a tax credit without a receipt? If your total work-related expenses are $300 or less, no receipts or written proof are required.

What amount does the IRS require receipts for? The IRS requires businesses to keep receipts for all business expenses over $75. Note that if your business is audited, you will still need to be able to provide basic information about expenses under $75, such as the date of purchase and business purpose.

How much can I claim without receipts UK?

In the UK there is no rule on the amount you can claim without a receipt. However, it should be reasonable for the tax inspector to accept it.

What happens if you don’t have receipts for tax return?

While it’s always best to hold on to any receipts, you may still be able to claim tax-deductible expenses if you don’t have one. You just need to be able to satisfy the tax inspector by showing that you made the purchase. So record the details around it – what was bought, from whom and how much it cost.

What is the maximum you can claim without a receipt?

If you claim more than $300, you may be required to provide written documentation for each individual expense, not just those incurred after the $300 limit is reached. If you are requesting $350 in expenses, you must provide documented documentation for the entire amount, not just the $50 you think is too much.

Comments are closed.