Are dental implants taxable

Are dental insurance premiums tax deductible in 2021?

Dental insurance premiums may be tax deductible. On the same subject : Dental Implants Orange County. The Internal Revenue Service (IRS) says that to be deductible as a qualified medical expense, dental insurance must be for procedures to prevent or alleviate dental disease, including dental hygiene and preventive examinations and treatments.

What medical expenses are deductible in 2021? What types of medical expenses are tax deductible?

- Payments to doctors, dentists, surgeons, chiropractors, psychiatrists, psychologists, and other medical professionals.

- Hospital and geriatric care.

- Acupuncture.

- Addiction programs, including smoking cessation.

Are insurance premiums tax deductible in 2021?

Is health insurance tax deductible? Health insurance premiums are federal tax deductible in some cases, as these monthly payments are classified as medical expenses. On the same subject : Cost For Dental Implants. Generally, if you pay for health insurance on your own, you can deduct the amount on your taxes.

Can you deduct health insurance premiums without itemizing?

Can you deduct health insurance premiums without having to itemize your returns? You may be eligible to claim health insurance on your own even if you don’t itemize deductions. This is an “above the line” deduction. Reduce income before calculating adjusted gross income (AGI).

Can I claim my insurance premiums on my taxes?

Health insurance premiums are federal tax deductible in some cases, as these monthly payments are classified as medical expenses. Generally, if you pay for health insurance on your own, you can deduct the amount on your taxes.

What dental expenses are tax deductible 2021?

The IRS allows you to deduct unreimbursed payments for preventive care, treatment, surgeries, dental and vision care, visits to psychologists and psychiatrists, prescription drugs, appliances such as eyeglasses, contact lenses, dentures, and hearing aids, and expenses that pay to travel for qualified medical care. To see also : Dentchers.

Is dental work tax deductible for 2021?

How much of the expenses can you deduct? In general, you can deduct on Schedule A (Form 1040) only the amount of your medical and dental expenses that is more than 7.5% of your AGI.

What is the medical and dental expense deduction for 2021?

In 2021, the IRS allows all taxpayers to deduct their unreimbursed qualified health care expenses that exceed 7.5% of their adjusted gross income. You must itemize your deductions on IRS Schedule A in order to deduct your medical expenses.

Is PMI still tax deductible in 2021?

The tax deduction for PMI was scheduled to expire in tax year 2020, but recently, legislation passed the Consolidated Appropriations Act of 2021 which effectively expands your ability to claim PMI tax deductions for tax year 2021. In short, yes, PMI tax is deductible for 2021.

Quand Peut-on bénéficier d’une Demi-part supplémentaire ?

You benefit from a demi-part supplémentaire if you respond to 2 subsequent conditions: You are over 74 years old on December 31, 2021. You have the card du combattant or you touch a pension militaire d’invalidité or war victim .

Comment remplir en ligne le formulaire 2042 C ?

To declare a 2042-C online, it is convenient to provide the ensemble of formularies and annexes duly complete with the course of the same declaration. The form is annexed to the main declaration in cochant simply case 2042-C. Il convient ensuite to fill the totalité des champs.

What type of dentist is best for implants?

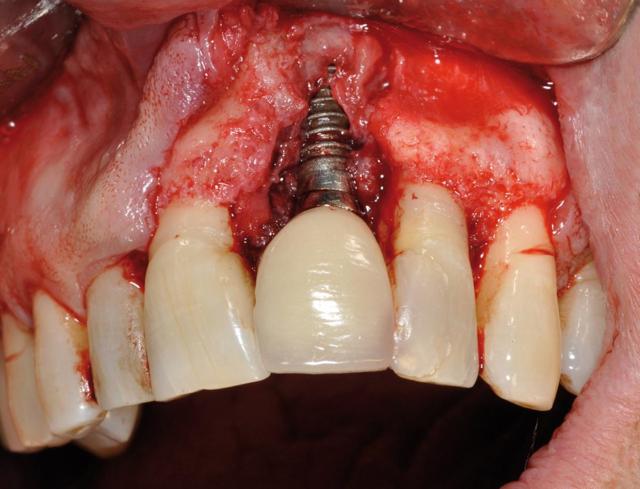

Periodontists are residency-trained specialists in implant dentistry and often provide the highest quality implant surgery treatment in the dental profession.

Should a periodontist or oral surgeon do an implant? Periodontists receive the highest level of training of any dental professional when it comes to implant procedures. Dental implants may be the best option for a person whose gum disease has reached the point of infection that cannot be treated.

What specialist is best for dental implants?

Oral or maxillofacial surgeon The most common options for a dental implant are an oral surgeon or a maxillofacial surgeon. All oral and maxillofacial surgeons train as general dentists before returning to school to study their specialty.

What are the 3 types of dental implants?

There are three common types of dental implants you can choose from: endosteal, subperiosteal, and zygomatic. The endosteal is the safest and most common, followed by the subperiosteal, and then the zygomatic is the last and most complex. It is rarely used.

What is the best choice for dental implants?

Your prosthodontist can help you determine which type of dental implant will work best for you, but endosseous implants are safe, effective, and the most popular option used today. Treatment: Endosteal implants begin by first drilling into the jawbone to insert a titanium screw that acts as an artificial root.

Is a periodontist better than an oral surgeon?

While oral surgeons specialize in the surgical side of dentistry, a periodontist has advanced surgical training in implant dentistry and is trained to improve oral health less invasively and without the need for advanced surgical procedures.

Can an oral surgeon do a gum graft?

An oral surgeon can treat gum tissue that is too thin. These scenarios are appropriate for a procedure known as gum grafting. This procedure, which can be performed by an oral surgeon, takes soft tissue from another part of the mouth and places it at the graft site. This is known as a free gingival graft.

What is the difference between a periodontist and an oral surgeon?

The Difference The bottom line is that a periodontist focuses on implants and gum health, while an oral and maxillofacial surgeon can perform a wide variety of surgical procedures on the mouth, jaw, and face.

Are eyeglasses tax deductible in 2021?

You may be surprised to learn that the money you spend on reading or prescription glasses is tax deductible. That’s because eyeglasses count as a “medical expense,” which can be claimed as a deductible itemized on Form 104 Schedule A.

What medical expenses are deductible 2021? In 2021, the IRS allows all taxpayers to deduct their unreimbursed qualified health care expenses that exceed 7.5% of their adjusted gross income. You must itemize your deductions on IRS Schedule A in order to deduct your medical expenses.

Are glasses and contacts tax deductible?

If you itemize your deductions, you can absolutely include the cost of contacts and glasses as medical expenses; You can also deduct the cost of your visit to your eye care professional. Those are legitimate health care expenses.

Are contacts tax deductible 2021?

Unreimbursed payments for prescription drugs and appliances such as eyeglasses, contact lenses, false teeth, and hearing aids are also deductible. The IRS also allows you to deduct expenses you pay to travel for medical care, such as your car mileage, bus fare, and parking fees.

Are eyeglasses tax deductible 2021?

You may be surprised to learn that the money you spend on reading or prescription glasses is tax deductible. That’s because glasses count as a “medical expense,” which can be claimed as a deductible itemized on Form 104, Schedule A.

Are prescription glasses a qualified medical expense?

IRS Form 969, which explains FSAs, HSAs, HRAs, and other tax-advantaged health plans, states that medical procedures are eligible if they are considered medical expenses on IRS Form 502. That would cover prescription lenses, whether they are used in sunglasses, eyeglasses or regular contact lenses.

Are prescription eyeglasses tax deductible in Canada?

Prescription glasses and contact lenses are allowable medical expenses that can be claimed on your tax return; however, corrective eyeglasses are one of the most overlooked deductions by Canadians.

Do prescription glasses count as a medical expense?

Here’s one of them: prescription glasses. You may be surprised to learn that the money you spend on reading or prescription glasses is tax deductible. That’s because glasses count as a “medical expense,” which can be claimed as a deductible itemized on Form 104, Schedule A.

What are dental implants called?

Dental implants (also called endosseous implants) are one component of a technique that replaces the tooth root with screw-like metal posts and installs a replica of the tooth that looks like the original tooth.

What are the 3 types of dental implants? There are three common types of dental implants you can choose from: endosteal, subperiosteal, and zygomatic. The endosteal is the safest and most common, followed by the subperiosteal, and then the zygomatic is the last and most complex. It is rarely used.

What is another name for dental implants?

A dental implant (also known as an endosseous implant or attachment) is a prosthesis that interacts with the jawbone or skull to support a dental prosthesis, such as a crown, bridge, denture, or facial prosthesis, or to act like an orthodontic anchor. .

Does medical cover dental implants?

Your health insurance may cover dental implants If the loss of a tooth has resulted in medical complications, your health insurance may provide coverage. Dental implants required after oral cancer may also be covered by health insurance.

What makes dental implants medically necessary? But, when the patient seeks dental implants because they would like to improve the function of their teeth or need the implants to correct a functional deterioration of their teeth, then the procedure is considered medically necessary.

Does Medi cal cover dental surgery?

Free and low-cost care for children and adults The Medi‑Cal dental program covers dental services for most Medi‑Cal members. Depending on your household income and family size, dental services may be free for you (and/or your child).

Est-ce que le numéro 36 46 est payant ?

Free prix appel service, from a landline or mobile phone. Depuis l’étranger : 33 1 84 90 36 46 (variable rate according to the telephone operator).

Où envoyer mon arrêt de travail ?

You will sometimes address the first 2 volets to the CPAM of your lieu d’habitation and the 3rd to your employee. Fonctionnaire : You sometimes adresser les volets 2 et 3 à votre administracion et garder le volet 1 pour vous. Il pourra vous serve in cases of control or medical examination.

Does Medi Cal or Medicare cover dental implants?

In most cases, Medicaid will not cover dental implants. This is because Medicaid is a government program that aims to provide additional financial support to low-income families who might not otherwise be able to afford dental and medical care.

Are dental implants covered by Medi Cal?

Dental implants are covered by health insurance when you can show that the treatment is medically necessary. Qualifying services are “appropriate for the evaluation and treatment of an illness, condition, or injury and are consistent with the applicable standard of care.”

What does Denti Cal cover for adults 2021?

Denti-Cal will only provide up to $1,800 in covered services per year. Some services don’t count toward the limit, like dentures, extractions, and emergency services. Your dental provider should check with Denti-Cal to find out if you have reached the $1,800 limit before treating you. appeals.

How much medical and dental expenses are deductible?

How much of the expenses can you deduct? In general, you can deduct on Schedule A (Form 1040) only the amount of your medical and dental expenses that is more than 7.5% of your AGI.

What is considered a medical expense for tax purposes? Health care expenses include payments for the diagnosis, cure, mitigation, treatment, or prevention of disease, or payments for treatment that affects any structure or function of the body.

How do you reimburse medical expenses?

Reimbursement of medical expenses can be claimed by presenting the original invoices to the employer. Accordingly, the employer would reimburse such expenses incurred subject to the total limit of Rs 15,000 without tax deduction.

How do you ask for Ameli reimbursement?

To claim your refund, I advise you to send your “feuille de soins” (claim form) to your CPAM. You can find the address of your CPAM on our website ameli.fr, under “Addresses and contacts”. If you need assistance with this request, you may contact CPAM.

How do I get reimbursed with Carte Vitale?

If you have a health card (“carte Vitale”) If you have already provided your bank details (“RIB” – relevé d’identité bancaire), the refund will be automatically credited to your bank account.

How do I get reimbursed for medical expenses in Luxembourg?

As a worker or beneficiary in the private sector, you can claim reimbursement of your medical expenses from the CNS. To do so, you must provide your health insurance fund with your bank account number on your first application and after registering with the CCSS.

Can I claim medical expenses abroad?

In the European Union (EU), a United Kingdom European Health Insurance Card (UK EHIC) or United Kingdom Global Health Insurance Card (UK GHIC) entitles you to the same state-funded health care as a United States citizen. country you are visiting.

How do I claim back medical expenses in Europe?

With a European Health Card (EHIC) With your EHIC you can receive health care and claim reimbursement for the costs incurred under the same conditions as citizens of the country in which you are. If the treatment you need is free to local residents, you won’t have to pay.

What are qualifying medical expenses?

Qualified medical expenses are generally the same types of services and items that might otherwise be deducted as medical expenses on your annual tax return. Some qualified medical expenses, like doctor visits, lab tests, and hospital stays, are also Medicare-covered services.

What account can only be used for qualified medical expenses?

A type of savings account that allows you to set aside pre-tax money to pay for qualified medical expenses.

What qualifies as unreimbursed medical expenses?

Unreimbursed Medical Expenses means the cost of medical expenses that would not otherwise be paid by insurance or some other third party, including medical and hospital insurance premiums, copays, and deductibles; Medicare A and B premiums; prescription drugs; dental.

Comments are closed.