Cosmetic medical procedures gross receipts tax bleaching dentistry

How much are LLCs taxed in NJ?

While some claim to pay a different tax to companies with less debt to allow them to do business in the region, New Jersey does not have any such tax for V LLC. On the same subject : Types Of Dental Services. Thus, in some cases, owners of LLCs choose to have tax treatment as an affiliation by filing Form 2553 with the International Revenue Service.

Do I need to renew my LLC Every year in NJ?

After you set up the LLC in New Jersey, you must file an Annual Report. This may interest you : Cosmetic dentistry cost toronto. You must file an Annual Statement in order to keep your New Jersey LLC in compliance and in good standing with the world.

What happens if LLC has no income?

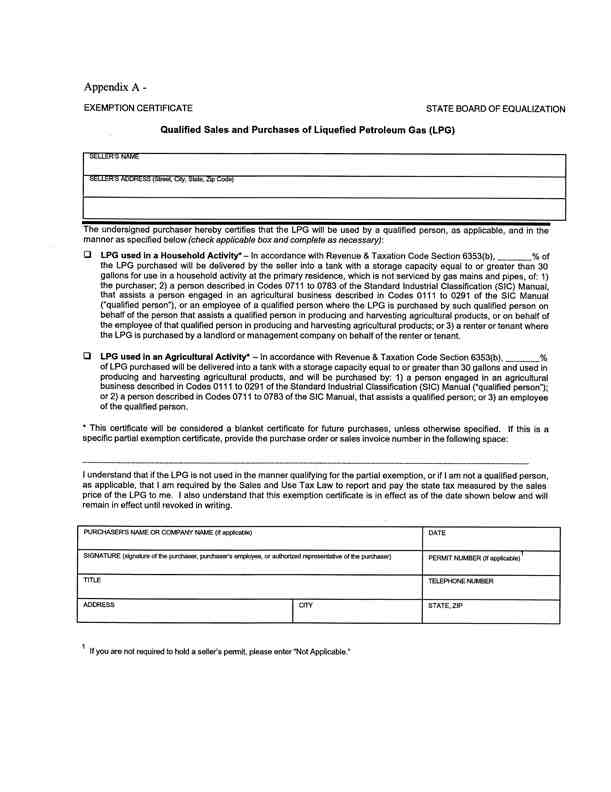

But even if it does not work LLC has no money or payment for a year, it may be necessary to file a federal tax return. LLC tax filters requirements depend on the way in which LLC is taxed. See the article : Cosmetic dentistry in west palm beach. The LLC may not be recognized as an organization because of taxes, or it may be tax deductible as a partnership or partnership.

Does an LLC expire in NJ?

Date Set: New Jersey LLC annual reports are updated annually at the end of your LLC celebratory year (i.e., the month you first registered your LLC with the government). Late Filings: Any annual report received after the due date will cause your business to be hostile to the world.

How much can a small business make before paying taxes?

As an individual owner or independent contractor, anything you earn about and more than $ 400 is considered a small business tax, according to Fresh Books.

Do sole proprietors pay federal tax?

Sole owners are responsible for paying: Federal tax money. State income tax, if this applies in your home situation. Self-employment tax.

How much money can you make before a hobby becomes a business?

What is the Hobby Revenue Limit? There is no set dollar limit, because some hobbies are more expensive than others. One of the reasons hobbies are not considered as a business is that hobbies are less or less profitable.

What deductions can a small business claim?

The top sixteen small business businesses are tax deductible

- Marketing and promotion.

- Food for business.

- Business insurance.

- Business interest and banking.

- Using your car business.

- Employee Agreement.

- Decrease.

- Education.

How do I file my LLC taxes in NJ?

Sole owners and non-members Software software should not be a business Revenue Tax return. They are considered to be sole proprietors of Taxes, and must file NJ-1040 or NJ-1040NR returns to claim and waive any tax revenue received from the business.

How much does an LLC cost yearly?

As of 2021, the average LLC’s annual salary in the US is $ 91. Many states call this Annual Report, however, with many other names: Annual Certificate. Annual List Members.

Does an LLC need to file a tax return?

One member LLC is considered a “negligent” tax on U.S. taxes. Where an individual LLC is a non-US member or position, new law 301.7701-2 (c) (2) (vi) (A) lists these organizations as companies.

What is the business tax rate in NJ?

New Jersey levies the highest corporate tax rate at 11.5 percent, followed by Pennsylvania (9.99 percent) and Iowa and Minnesota (both at 9.8 percent). Two other countries (Alaska and Illinois) set prices above 9 percent.

What income does NJ tax?

Personal tax 1.4% on the first $ 20,000 tax deductible. 1.75% on tax payable between $ 20,001 and $ 35,000. 3.5% on tax payable between $ 35,001 and $ 40,000. 5.525% on tax payable between $ 40,001 and $ 75,000.

What is tax rate on business income?

The full company tax rate is 30% and the minimum company tax rate is 27.5%.

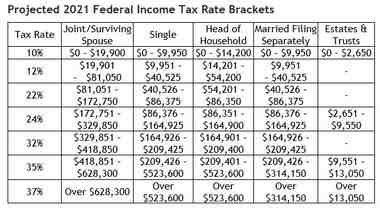

What are the New Jersey income tax rates?

New Jersey 2019 Available Bracket, Rate and Estimated Taxes Required

- Tax Tax: 1.4% Income Tax: $ 0 – $ 20,000. …

- Tax Tax: 1.75% Income Tax: $ 20,000 – $ 35,000. …

- Taxes: 3.5% Income Fees: $ 35,000 – $ 40,000. …

- Eligible Taxes: 5.525% Income Fees: $ 40,000 – $ 75,000. …

- Eligible Taxes: 6.37% Income Fees: $ 75,000 – $ 500,000. …

- Eligible Taxes: 8.97% …

- Eligible Taxes: 10.75%

Comments are closed.