Do dental work and implants is tax deduction

What dental expenses are tax-deductible?

The IRS allows you to deduct unreimbursed expenses for preventive care, treatment, surgeries, and dental and vision care as qualified medical expenses. On the same subject : What Are. You can also deduct unreimbursed expenses for visits to psychologists and psychiatrists.

What dental expenses are not tax deductible? Examples of medical and dental payments you CANNOT deduct: Teeth whitening. Veterinary fees. Cosmetic surgery unless it is necessary to improve a deformity related to a congenital anomaly, an injury from an accident or trauma, or a disfiguring disease. Life insurance or income protection policies.

Are dental crowns tax deductible?

Veneers, crowns, and caps placed on your teeth for cosmetic reasons cannot be deducted or counted toward your medical expenses when you file your taxes. Read also : How.much are dental implants. Internal Revenue does not allow a taxpayer to deduct work done on healthy teeth just to make the person look more attractive.

Are pensions deductible?

In the United States, an employer’s pension contribution is deductible when calculating corporate income taxes, and investment earnings on plan assets are not taxable. Employee is taxed once: Personal income tax liability is deferred until the employee receives a distribution from the plan.

Are dental crowns tax deductible in Canada?

To help you with this cost, the Canada Revenue Agency allows dental expenses to be used as deductions for medical expenses when you file your tax return. Dental expenses include fillings, dentures, dental implants, and other dental work not covered by your insurance plan.

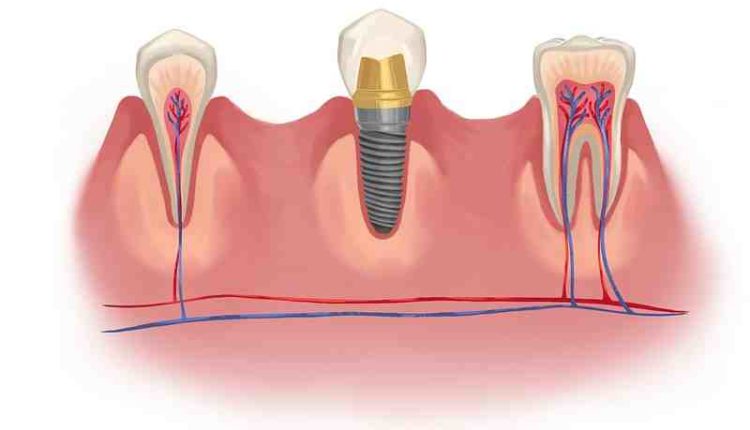

What is the downside of dental implants?

The risks and complications you are taking for dental implants include infection, damage to other teeth, delayed bone healing, nerve damage, prolonged bleeding, jaw fractures, and more. This may interest you : Metal Posts. If you are willing to take these risks, dental implants may be right for you.

What is the failure rate of dental implants? Dental implants have a high success rate, but some people experience dental implant failure. It is estimated that about 5 to 10 percent of dental implants fail, either shortly after a procedure or months or years later.

Do dental implants last forever?

How long do dental implants last? With regular brushing and flossing, the implant screw itself can last a lifetime, assuming the patient receives regular dental checkups every 6 months. However, the crown typically only lasts 10-15 years before it needs replacement due to wear.

Do dental implants lower life expectancy?

Tooth loss could shorten your life! Fortunately, however, dental implants can restore your smile and perhaps increase its longevity. dr

How many times can you replace dental implants?

When maintained with proper hygiene and controls, dental implants can last a lifetime. The crown attached to the implant will generally need to be replaced every 15 to 20 years, although in some cases it can last for several decades.

How painful is getting a dental implant?

A simple dental implant, for a patient with good bones and who doesn’t need a lot of soft tissue surgery, has a pain level of between two and three in the first 24 to 48 hours, which means over-the-counter medications like Tylenol or Advil are will take care of any discomfort you are feeling.

What hurts more tooth extraction or implant?

It is suggested that the intensity of pain is greater with dental extraction compared to the implant placement procedure.

How long does a dental implant procedure take?

The procedure itself takes 1-2 hours and healing time is 3-6 months. During this time, the titanium alloy implant (the same material used in joint replacement) will heal and fuse with the surrounding bone tissue. No other weight-bearing medical implant has such fast healing or recovery times.

How soon after tooth extraction can you have implant?

Early implant placement Usually takes place two to three months after an extraction. The waiting period allows your gums to heal. If you have an oral infection, it will also need to be cleared up prior to implant placement.

Can you get a temporary tooth while waiting for an implant?

Temporary Crown While you wait for implants, temporary crowns may be a good option. It is usually made of acrylic plastic and will be cemented into place by the dentist. The crown offers an aesthetically pleasing option. It will appear like a real tooth, although the patient must be careful when eating hard foods.

Can you have tooth extraction and implant on same day?

Same Day Dental Implants With same day implants, your surgeon will extract the problem tooth and place an implant in the extraction site on the same day. This procedure has drastically reduced the waiting time, allowing patients to solve their dental problems in the shortest possible time.

How long after a tooth is pulled Can you get an implant?

Early implant placement Usually takes place two to three months after an extraction. The waiting period allows your gums to heal. If you have an oral infection, it will also need to be cleared up prior to implant placement.

Can a temporary tooth be obtained while waiting for an implant? Temporary Crown While you wait for implants, temporary crowns may be a good option. It is usually made of acrylic plastic and will be cemented into place by the dentist. The crown offers an aesthetically pleasing option. It will appear like a real tooth, although the patient must be careful when eating hard foods.

What happens if you don’t get an implant after tooth extraction?

Delay tooth extraction complications If a tooth is missing for as little as 12 months without an implant being placed in its place, bone loss is likely to occur and the need for other procedures such as sinus lift or bone grafting may arise. The teeth surrounding the space are also likely to shift if the space is not treated.

Can I get an implant 2 years after extraction?

If you had teeth removed 2, 5, 10, or any number of years ago, and haven’t replaced them since then, you may still be a good candidate for dental implants. It is primarily a matter of bone density.

Is dental implant necessary?

Dental implants are necessary when you have missing teeth but are unable or unwilling to get dentures, bridges or crowns. It is important to replace a missing tooth, as the consequences of extracting/losing a tooth and doing nothing can become much more of a problem as time goes on.

Can a dental implant be done same day as extraction?

Same Day Dental Implants With same day implants, your surgeon will extract the problem tooth and place an implant in the extraction site on the same day. This procedure has drastically reduced the waiting time, allowing patients to solve their dental problems in the shortest possible time.

Can I get an implant 2 years after extraction?

If you had teeth removed 2, 5, 10, or any number of years ago, and haven’t replaced them since then, you may still be a good candidate for dental implants. It is primarily a matter of bone density.

Can you wait too long to get dental implants?

If you wait more than a year to get your dental implant, you may need to have bone grafting done to ensure stability and strength in your jaw. During this procedure, your oral surgeon removes small pieces of bone from one area of your mouth and transfers them to the area that will receive the implant.

Can tooth implant be done after 2 years?

Whether or not you have remained long after your teeth have been extracted is not a reason not to have dental implants. So it doesn’t matter how many years you’ve spent; 3, 5, 10 or any number of years past, you can still have your dental implant surgery.

Can I use my 401k for dental implants?

Borrowing from a retirement savings fund, such as a 401(k), 403(b), or 457(b), is often considered a viable way to pay for dental implant procedures like TeethXpress. This option includes many advantages, such as low monthly payments that can be spread, in many cases, over a period of five years.

Can dental implants be canceled in taxes? Yes, dental implants are tax deductible. It also explains: “Health care expenses include payments for the diagnosis, cure, mitigation, treatment, or prevention of disease, or payments for treatment that affects any structure or function of the body.” This would include dental implants.

What makes you not a candidate for dental implants?

Certain health conditions, including cancer, hemophilia, diabetes, and autoimmune disorders, may preclude a person’s candidacy for dental implants because these conditions can affect their ability to heal. Some of these conditions can also cause serious infections after the procedure.

When is a dental bone graft not possible?

A bone graft can become infected or fail due to problems with your health or post-surgery care. If the material used in the bone graft is infected with bacteria, the graft will fail. Also, if the tools used are infected, there is a possibility that the infection will be transferred to the patient.

Is everyone a good candidate for dental implants?

But not everyone is a viable candidate for implants, and ironically, the most common reason has to do with the bone. If a patient has suffered significant bone volume loss, either through disease or the long-term absence of natural teeth, there may not be enough bone to adequately support an implant.

Can I use my HSA for dental implants?

You can use your Health Savings Account to pay for a wide range of dental treatments. These include dental cleanings, digital x-rays, fillings, crowns, root canals, dental implants, and even bridges. You can even use the money you save for cosmetic work, like teeth whitening treatments.

Can I use my HSA for a crown?

Corrections and Treatments Use the money in your HSA to help cover the cost of bridges, crowns, inlays and out-of-pocket expenses. Other eligible expenses that an HSA should help cover include extractions, root canals and any deep cleaning of the gums to treat periodontitis.

What dental expenses are not HSA eligible?

Some common dental procedures where you cannot use your HSA or FSA are: Cosmetic surgery that is not medically necessary… You can use your HSA or FSA to:

- Suspenders.

- Dentures.

- Sealants.

- Fluoride treatments.

- Dental cleaning.

- X-rays.

- Extractions.

- fillers

Can I borrow from my 401k for dental work?

Most 401(k) plans allow account holders to borrow from their vested balance. Generally, participants can borrow up to 50 percent of that balance, up to a maximum amount of $50,000.

What medical expenses qualify for a 401k hardship withdrawal?

You may qualify for a penalty-free withdrawal if you meet one of the following exceptions: You become totally disabled. You are in debt for medical expenses that exceed 7.5 percent of your adjusted gross income. You are required by court order to give the money to your divorced spouse, child, or dependent.

What reasons can you withdraw from 401k without penalty?

If you leave, resign, or are terminated from the company at age 55 or older, you can withdraw that account in a lump-sum withdrawal without incurring a penalty. If you’re under 55 (or if you prefer), you have up to 60 days to roll over your funds into a new 401(k) or IRA without triggering a taxable event.

What medical expenses are tax deductible 2022?

For tax returns filed in 2022, taxpayers can deduct unreimbursed qualified medical expenses in excess of 7.5% of their 2021 adjusted gross income. So, if your adjusted gross income is $40,000, all you more than the first $3,000 of medical bills, or 7.5% of your AGI, may be deductible.

Are health insurance premiums tax deductible in 2022? You can withdraw or deduct up to $450 tax-free to pay for long-term care premiums in 2021 and 2022 if you are age 40 or younger, $850 if you are age 41-50, $1,690 if you are age 51-60, $4,510 ($4,520 in 2021) if you are between the ages of 61 and 70, or $5,640 if you are over the age of 70.

What medical expenses are not tax-deductible?

What medical expenses are not tax deductible? Medical expenses that do not qualify include cosmetic surgery, gym memberships or health club dues, diet foods, and over-the-counter drugs (except insulin). Medical expenses are deductible only if they were paid out of pocket in the current tax year.

What qualifies as deductible medical expenses and what doesn t?

You can deduct unreimbursed qualified medical and dental expenses that exceed 7.5% of your AGI. 1 Let’s say you have an AGI of $50,000 and your family has $10,000 in medical bills for the tax year. You could deduct any expenses greater than $3,750 ($50,000 × 7.5%), or $6,250 in this example ($10,000 – $3,750).

Can you deduct health insurance premiums on taxes?

If you buy health insurance through the federal marketplace or your state marketplace, any premium you pay out of pocket is tax deductible. If you are self-employed, you can deduct the amount you paid for health insurance and qualified long-term care insurance premiums directly from your income.

What are IRS qualified medical expenses?

Common medical expenses qualified by the IRS

- Acupuncture.

- Ambulance.

- artificial limbs.

- artificial teeth*

- Birth control treatment.

- Diabetic blood sugar test kits.

- Breast pumps and lactation supplies.

- Chiropractor.

What is not considered a qualified medical expense?

Expenses NOT eligible for an HSA Tax on hospital insurance benefits, withheld from your pay as part of Social Security tax or paid as part of Social Security self-employment tax. Nursing care for a healthy baby. Trips your doctor told you to take to rest or change.

What are qualified medical expenses for HSA purposes?

HSA – You can use your HSA to pay for eligible medical, dental, and vision expenses for yourself, your spouse, or eligible dependents (children, siblings, parents, and others who are considered an exemption under Section 152 of the tax code) .

What kind of medical expenses are tax-deductible?

Deductible medical expenses may include, but are not limited to, the following: Payments for fees to physicians, dentists, surgeons, chiropractors, psychiatrists, psychologists, and non-traditional physicians.

What qualifies as deductible medical expenses and what doesn t?

You can deduct unreimbursed qualified medical and dental expenses that exceed 7.5% of your AGI. 1 Let’s say you have an AGI of $50,000 and your family has $10,000 in medical bills for the tax year. You could deduct any expenses greater than $3,750 ($50,000 × 7.5%), or $6,250 in this example ($10,000 – $3,750).

What medical expenses are tax deductible 2022?

For tax returns filed in 2022, taxpayers can deduct unreimbursed qualified medical expenses in excess of 7.5% of their 2021 adjusted gross income. So, if your adjusted gross income is $40,000, anything over the The first $3,000 of medical bills, or 7.5% of your AGI, may be deductible.

Comments are closed.